- cross-posted to:

- climate@slrpnk.net

- canada@lemmy.ca

- cross-posted to:

- climate@slrpnk.net

- canada@lemmy.ca

It’s really hurting us in Colorado. We’ve had a huge increase in hail the past few years which has caused our insurance premiums to skyrocket across the state for home and auto both.

We paid extra out of our own pocket to upgrade to hail resistant shingles in our last claim, so now insurance will replace like for like if it happens again, and hopefully also reduces the risk of damage and the need for a claim. Doesn’t impact the premium though, lol.

https://www.onpointcontractingusa.com/blog/hail-damage-in-colorado/

-

During 2023, reports of baseball-sized hail (over 3 inches) in Colorado surged nearly threefold since 2019, climbing from 12 to 34, pointing to more frequent extreme hail events.

-

Similarly, reports of softball-sized hail (approximately 4 inches) increased to 13 in 2023, according to NWS Denver, nearly tripling earlier counts and signaling a worrying escalation in storm intensity.

Aside from property damage, I imagine that it kinda sucks to be caught outside if softball-sized hail is coming down.

-

So glad to live in the Pacific Northwest. (Please no big earthquakes, please no big earthquakes…)

It’s also possible to make homes resistant to disasters, but that also costs money itself. A lighthouse is an extreme example — it can ignore wind-blown hurricane debris and flooding.

But they are not cheap to build.

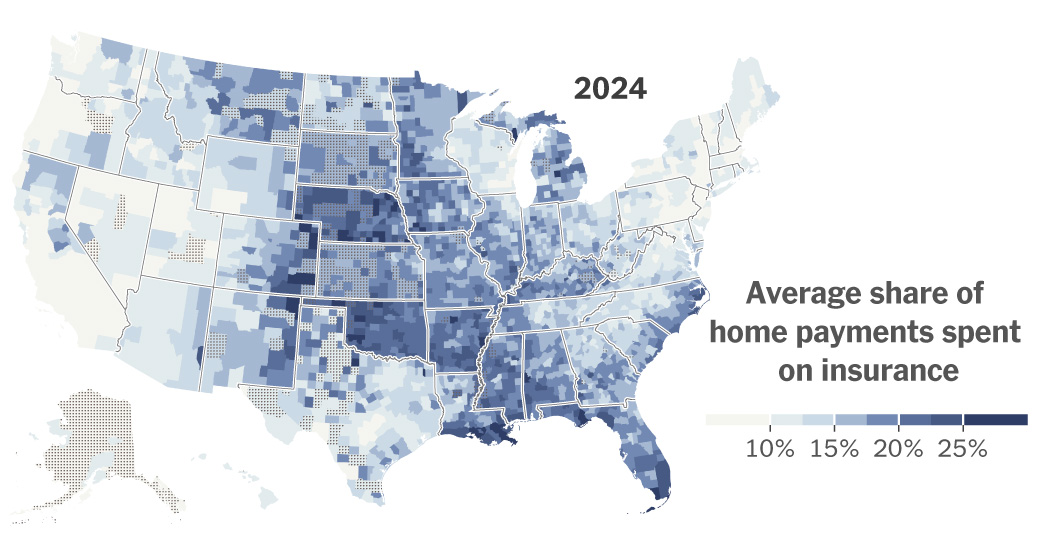

Aside from Florida, this is just a map of how expensive land is (or isn’t).

I wish. I I’d be buying half the PNW if that was the case.

It’s a combination of that with areas prone to floods, strong winds and forest fires.

The heat map shows insurance in California is cheap. Between fire, flood, and earthquake insurance, and being HCOL, I can assure it is not. If you can find it at all. And LA is still smoldering from the fires last January.

The property values are insanely high in California, which makes insurance as a percent of property values seem low, even if it isn’t in absolute terms.

A million-dollar condo by the coast pays more in insurance than an identical condo in a LCOL area, but the property value masks that when considered as a percent.

Hence my original comment.

Redo this as insurance cost per square foot and it’d be much more useful.